What does it take to raise seed funding as an AI-first SaaS startup? (Seed Edition —the 0.9 version )

At Point Nine, we have been focused on investing in SaaS companies and have been fortunate to work with several generations of successful businesses in this segment over the years. Since joining the firm 24 months ago, I’ve spent a significant share of my time looking at SaaS companies using machine learning to change industries.

From my vantage point, it appears that we’re now at a turning point when it comes to the use of AI in B2B applications. I published this post to that effect 18 months ago and I thought it was time to dive deeper into the topic with the benefit of hindsight and data. To that end, I’ve attempted to consolidate our thoughts on investing in AI-first SaaS businesses by creating a customary Point Nine napkin! Why? Because this is the format we typically use at Point Nine to consolidate our thoughts (see our SaaS and Marketplace funding napkin here and there) 😉

This post consists of 3 parts:

- First, I will share a quick historical perspective on the broader SaaS industry and use it to explain some of the key success factors of each of these generations at a (very) high level,

- Second, I define what I call an “AI-first SaaS business” and outline a work-in-progress investment thesis for seed stage startups in this category,

- Third, I try to explain why AI-first SaaS is an exciting category based on the analysis of some of their intrinsic characteristics.

I believe that positioning AI-first SaaS companies within the broader SaaS landscape provides an interesting perspective but if you’re just interested in understanding our investment criteria for AI-first SaaS startups, just go directly to part 2!

A quick historical perspective on the SaaS industry — categories and investment strategies

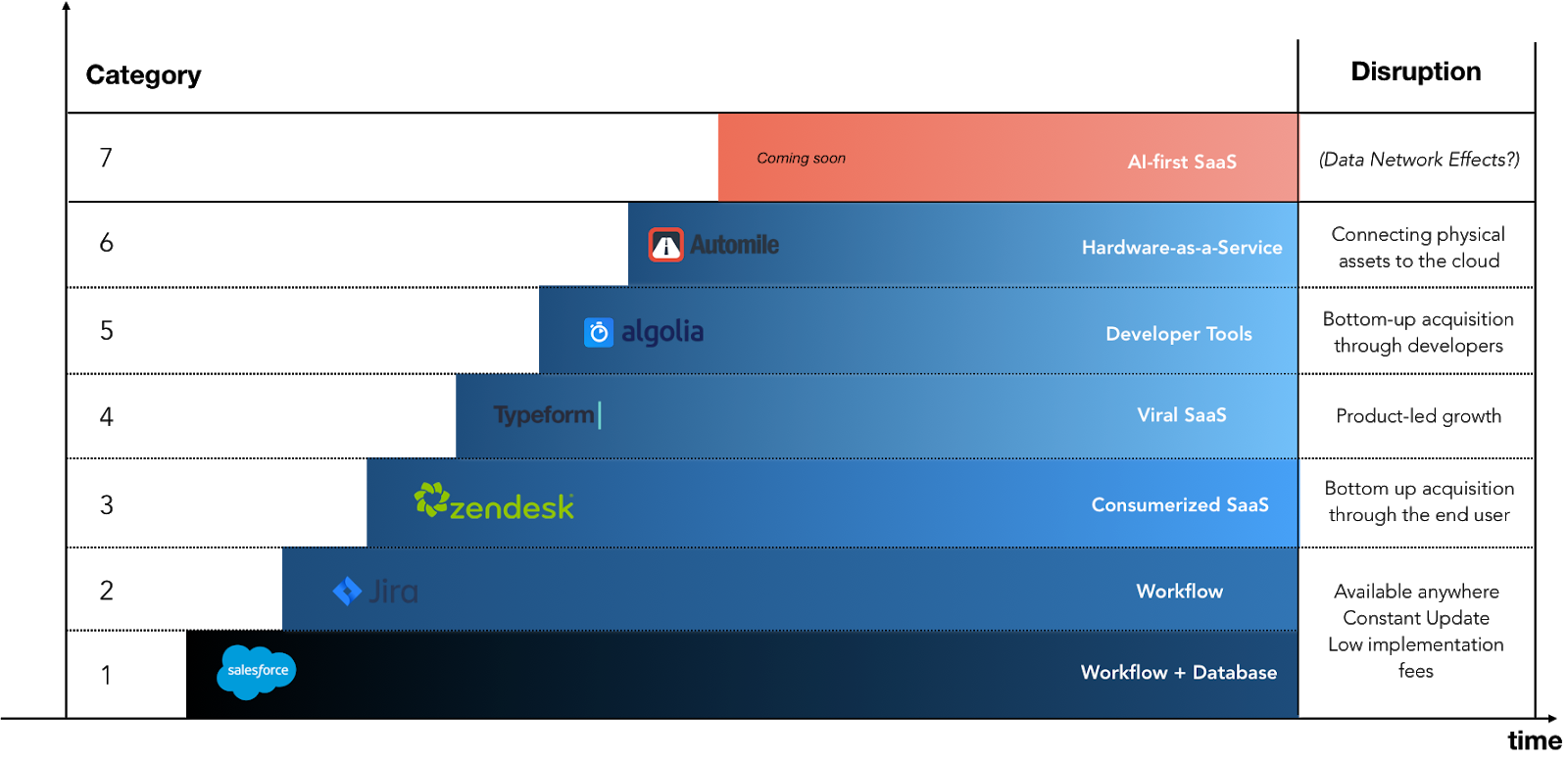

At a high level, we can observe 6 different innovation trends that have shaped the SaaS industry over the past 15 years, as described in the graph below:

I believe that AI-first companies are forming a seventh category that started shaping up some months ago and I will try to explain why in this post. This categorisation is more exemplary than exhaustive as it tries to cover a vast majority of successful SaaS companies, from Salesforce to Typeform via Stripe… These categories are also not mutually exclusive and some companies fit in several ones.

For the sake of simplicity, I will not go into details of each category but at a high level, here’s how we could look at it:

- Initially, SaaS companies built products that consisted of a “workflow app + a database” to disrupt the on-premise software industry. Why? Because i) they were accessible from anywhere, ii) could be constantly updated, iii) required low implementation fees, iv) were cheaper to manage … and had lots of other now well-understood advantages of SaaS over on-premise. Some of the most successful companies of this trend include Salesforce, Veeva or Workday.

- A second category covers the “workflow-only apps”. They’re less defensible companies because they’re not actual Systems of Records and mainly improved user experiences. Even so, we can still count a few large successes such as Trello, Asana or Jira.

- A third generation, born after 2007, includes the “consumerized SaaS startups with bottom-up distribution”. These took advantage of very intuitive user experiences in order to first appeal to the end user before selling to enterprise customers. Zendesk, Front or Slack are great examples of this category.

- A fourth generation of SaaS startups relied on another very efficient go-to-market strategy, driven this time by intrinsically viral product features — we call these companies “viral SaaS”. While some initially wondered how they would be able to grow and maintain healthy unit economics at scale because of their relatively low ARPAs, history has proven that these companies could keep on adding customers at stable or even decreasing acquisition costs thanks to virality. Typeform or Calendly have this model in common.

- In parallel, some companies started building the picks and shovels of SaaS applications and made product engineering much more efficient by abstracting underlying complexity. Algolia, Twilio or Stripe are great examples of this category called “developer tools”. Beyond the quality of their product, they also brought a new distribution strategy as they all managed to get top dollars from enterprise customers while initially having started to sell to individual developers.

- A last category that needs to be mentioned here is “Hardware as a Service”. As hardware production costs keep dropping with the standardization of manufacturing lines, SaaS companies could afford to distribute hardware at a low cost to track and/or control physical assets in the cloud. This brought interesting companies such as Automile, Square or Scandit.

Each of these innovation trends have shaped the broader SaaS landscape. At Point Nine, we try to build new (and unproven) hypotheses as each generation emerges. Why? Because taking new risks is the only way to find great outcomes (check this post for more on that).

Also, if you’re interested in some recent example of our approach to new investment thesis generation, check Rodrigo’s

Hardware as a Service investment thesis in 2015 or our updated SaaS investment thesis.

In the next part, I’ll try to explain my hypotheses when looking at AI-first SaaS businesses.

AI-first SaaS startups

First, let’s start with a definition:

“AI-first SaaS companies use data and machine learning algorithms at their core to build disruptive product experiences.”

If you’re wondering what “at their core” means, this

article does a really good job.

While most AI companies at the Series A or B stage start showcasing revenues that are not so different from a typical SaaS startup, they tend to look very different at the seed stage. This is in part because building a ML-powered software today is more complex and takes more time than building a typical SaaS startup. On top of all the challenges that comes with building a SaaS company, AI-first SaaS businesses need to:

- Identify problems and experiences well suited to a data-driven solution

- Collect and label data

- Extract value from the data by building models with or without feature engineering

- Find early customers to validate and contribute to the (future) value of their learning system.

The good news it that the expectations of VCs when it comes to AI-first SaaS startups also differ from those for other types of SaaS startups. Hence, if we were to wait to have the same revenue metrics for an AI-first SaaS startup than for a typical SaaS startups, we would probably miss all the seed-stage AI deals.

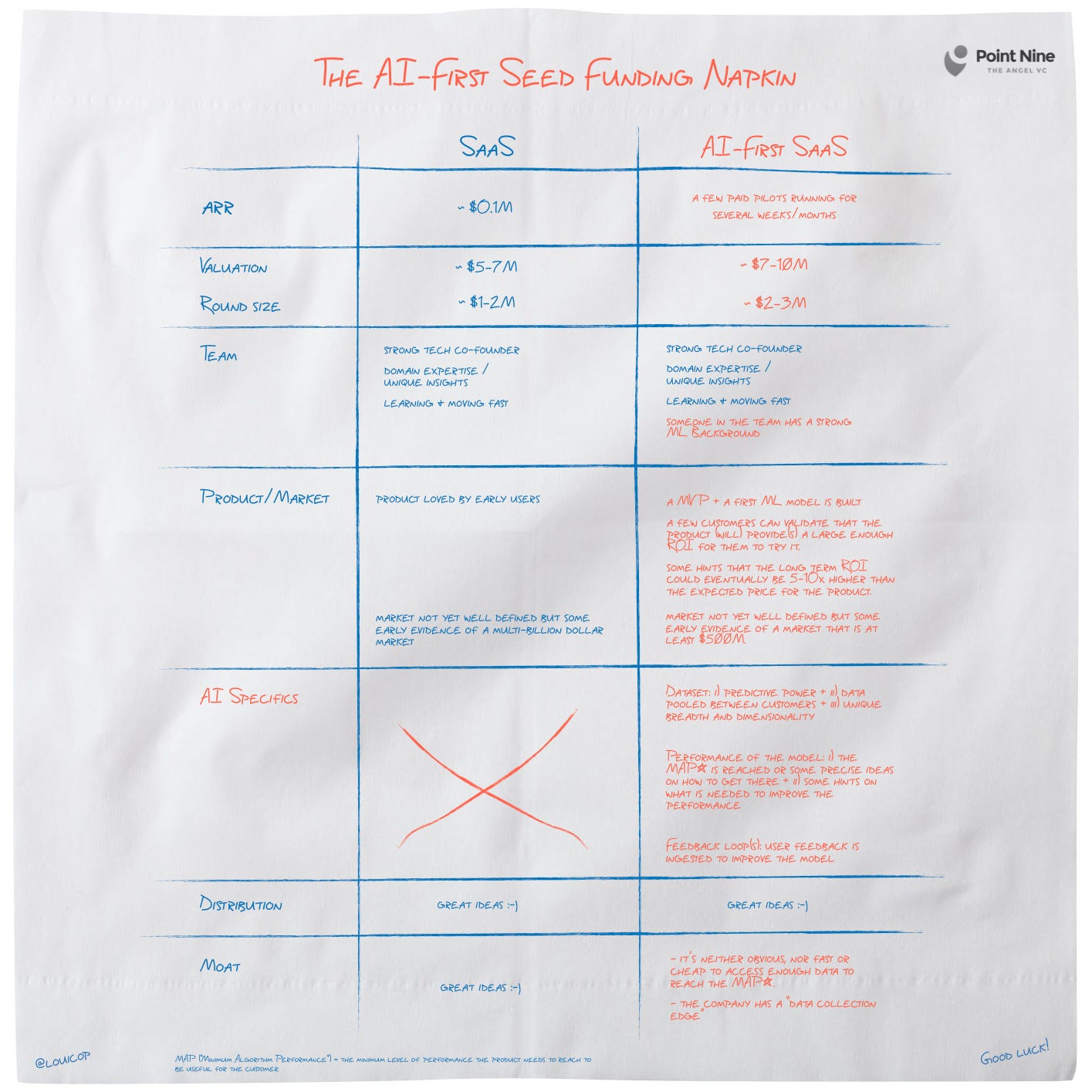

Now, without further ado, here is a WIP investment thesis for AI-first SaaS businesses at the seed stage. Consider this a .9 version (it has not yet made it until v1.0) and it’ll likely evolve many times as we keep on investing in AI-first businesses. Our SaaS funding napkin also evolved a bunch of times already (see the 2016, 2017, 2018 versions here).

Revenue

- The company has a few paid pilots running.

- Some early indications that customers will be ready to pay a significant amount of money once the product will be running in production.

- No, MRR is not a requirement!

Valuation / Round size

- $2–3M round at pre-money valuation between $6 and 10M pre-money.

- As mentioned earlier, AI-first businesses tend to raise a little more money at a higher valuation currently than other traditional SaaS businesses.

- The round size and valuations are impacted by lots of different factors but to put a range here, round size and valuation are typically 20–50% larger than traditional software companies (consistent with what MMC found in their research surveying UK based startups).

Product

- A Minimum Viable Product that demonstrates what an AI model can do (a.k.a a MVP and a first model has been built).

Customer validation

- It addresses an important pain point (can be read as “in the top 3 priorities of the buyer”) for a well defined target audience.

- Customers can validate that the product has a chance to provide a large enough ROI for them to try it or to switch from competing non AI-powered SaaS products. The challenge here is that even if the ROI is not massively superior to “dumb” products, it still needs to be sufficiently superior for customers to switch product, contribute their data and eventually get a much better product than they used to. Don’t ask me to define sufficiently superior, only customers can 🙂

- A good indication that, longer term, the ROI driven by the usage of the product could be 5–10x higher than the expected price for which it will be sold and will increase with time as the product ingests more data.

Market

- One unvalidated assumption that we have here is that smaller markets (in the few hundred millions) could still be large enough because AI-first SaaS companies have winner takes all dynamics (check out the last part of this article for that) that typical SaaS companies do not have.

AI specifics

- Data

- Predictive power: the initial dataset has predictive power according to the problem the company is trying to solve.

- Shared learnings: the data from each single customer can be pooled into a larger learning dataset.

- Size: the number of features (dimensionality) and the size of the dataset (breadth) is (or will be) unique compared to other datasets owned by competitors.

- Performance of the model

- The team has already reached or has precise ideas on how much data, time or money is required to get to an accuracy level that is significant enough for customers to use the product (a.k.a reach the “Minimum Algorithmic Performance” = the minimum performance to justify adoption). This term that was initially coined by our friends at Zetta (if you want to learn more, check this post out).

- The team knows what performance benchmarks are relevant to the customer judging their product.

- Feedback loop(s)

- The user feedback is closely integrated in the product. It is used in order to generate a superior model performance and, more broadly, a superior product experience.

- Bonus point if the User Experience is adapting depending on what kind of data is required to improve the algorithm’s performance (experts call this Interactive Machine Learning).

Distribution

- Some ideas or early signals that there will be an efficient way distribute the product (a.k.a. a way to maintain a good ACV vs. CAC ratio at scale). Not sure what this means, check Christoph’s “5 Ways to build a 100M business”, it works for all generations of SaaS companies including AI-first businesses.

Defensibility

- It’s neither obvious, nor fast nor cheap to access enough data to reach the MAP.

- “Data Collection Edge”: the company has an edge (e.g. a first mover advantage or unique access to proprietary data), which will prevent other players with more resources to gather more data faster and eventually have better algorithmic performances. I wrote a whole post a year ago on the topic: check it out!

Want a napkin version and compare it with other SaaS startups? Here it is!

What is exciting about AI-first SaaS startups?

Now, beyond laying down new assumptions with the risk of being proven wrong in a few years, why should we still invest in AI-first SaaS startups and take these new risks?

1. Faster growth

By essence, AI-first SaaS companies generate a ROI for the customers that is a growing function of the amount of data ingested, time and product usage.

This means that, all things being equal (product maturity, sales and marketing efforts), we can expect AI-first SaaS startups to provide a growing ROI to their customers and eventually have a faster growth driven by faster growth of the new MRR and larger expansion numbers.

Primarily for two reasons:

- as the value of the product increases over time, customers will be willing to pay more for it. Hence, the ACV will increase until it reaches a certain asymptote that will be a percentage of the maximum ROI provided by the software.

- It will be easier for sales people to convince later stage adopters.

This fast growth will nonetheless be capped once the ROI has reached a certain level.

2. Lock-in / Sticky usage

Additionally, the more users contribute their own data to the product, the less they’re likely to churn because the product has become better and it has been able to adapt to each of their specificities. Each new data labeled by a user is essentially increasing the lock-in of this specific customer and increasing the overall value of the product.

Take Facebook as an example, another reason why Facebook is so defensible beyond the fact that you find 99% of your friends on the platform (for now) is that the feed of any other social media that would start from scratch would look much less interesting because they would not know about your past preferences.

3. Monopoly in B2B software?

From an an investment return perspective, VCs want to fund companies that have the potential to become category leader and (outrageously) dominate their market. Investors keep on being so interested in marketplace because they have winner-takes-all dynamics for example. We could argue here that AI-first companies have similar dynamics.

The table below explains why:

Historically, SaaS companies have become defensible for a number of reasons but we can’t argue that they brought winner-takes-all dynamics to the markets they’ve been operating in.

Al-first startups have lots of new challenges that the first generations did not have, but I believe that a small number of them will eventually build monopolies.

It’s an exciting period to be in for SaaS investors!

So… if you’re building an AI-first SaaS company (and strongly believe that you’re building a data monopoly) or just want to discuss this initial investment thesis, send me an email louis@pointninecap.com, I’d love to chat!

Leave a Reply