Financial Inclusion and Donation Tracking

Finance is the most intuitive use case for blockchains. Bitcoin was introduced as a digital currency offering the extra features of “anonymity” which allows for greater privacy, fewer transaction fees which allows for high volume and microtransactions, and removal of barriers which allows for cross-border payments. Typical financial use cases include IoT micropayments, remittances, claims management, and securities trading. But while most of us who are able to access Medium live in a country with a reliable currency system and access to financial services, there are billions of people whose financial opportunities can be dramatically improved with cryptocurrency technology.

Let’s say a woman in India discovers she can apply her skills to start a small business. However, she does not have the initial capital to get started, and she is one of 2 billion people in the world with no access to banking/financial services so loan options in her community are scarce; debt bondage is also unfortunately prevalent in India. We can envision cryptocurrencies — frictionless digital money that transcends large financial institutions and international borders — helping those that banks have failed to reach.

Perhaps, in the future, everybody will transact with digital currencies. You and I, sitting across the world from the woman in India, will be able to easily loan money via smart contract and track exactly where the money goes; she will be able to build her credit through a reputation tracker built into the application. Retailers and CPG companies who participate in charities can set up “5% of all sales” donations as smart contracts such that consumers purchasing those products will be able to verify and see the impact of their donations. Note that this particular vision excludes the anonymity capabilities of cryptocurrencies, and perhaps even requires centralized identity services.

Because finance is the simplest blockchain use case, it also reveals the technology’s most fundamental problems. Cryptocurrency will only become mainstream if it exceeds what consumers expect from traditional applications: it needs to be faster, cheaper, and more accessible — none of which are really true today.

I’ll talk about accessibility first: assuming we can get financial services to everyone with smartphone access, we’ve helped a laughably small portion of the unbanked.

But say some benevolent donor generously paid for everyone to have some kind of electronic wallet and everyone can transact with cryptocurrencies. To maintain the system, we also have to pay for people to host nodes and validate transactions — a nontrivial cost increase if you want true decentralization.

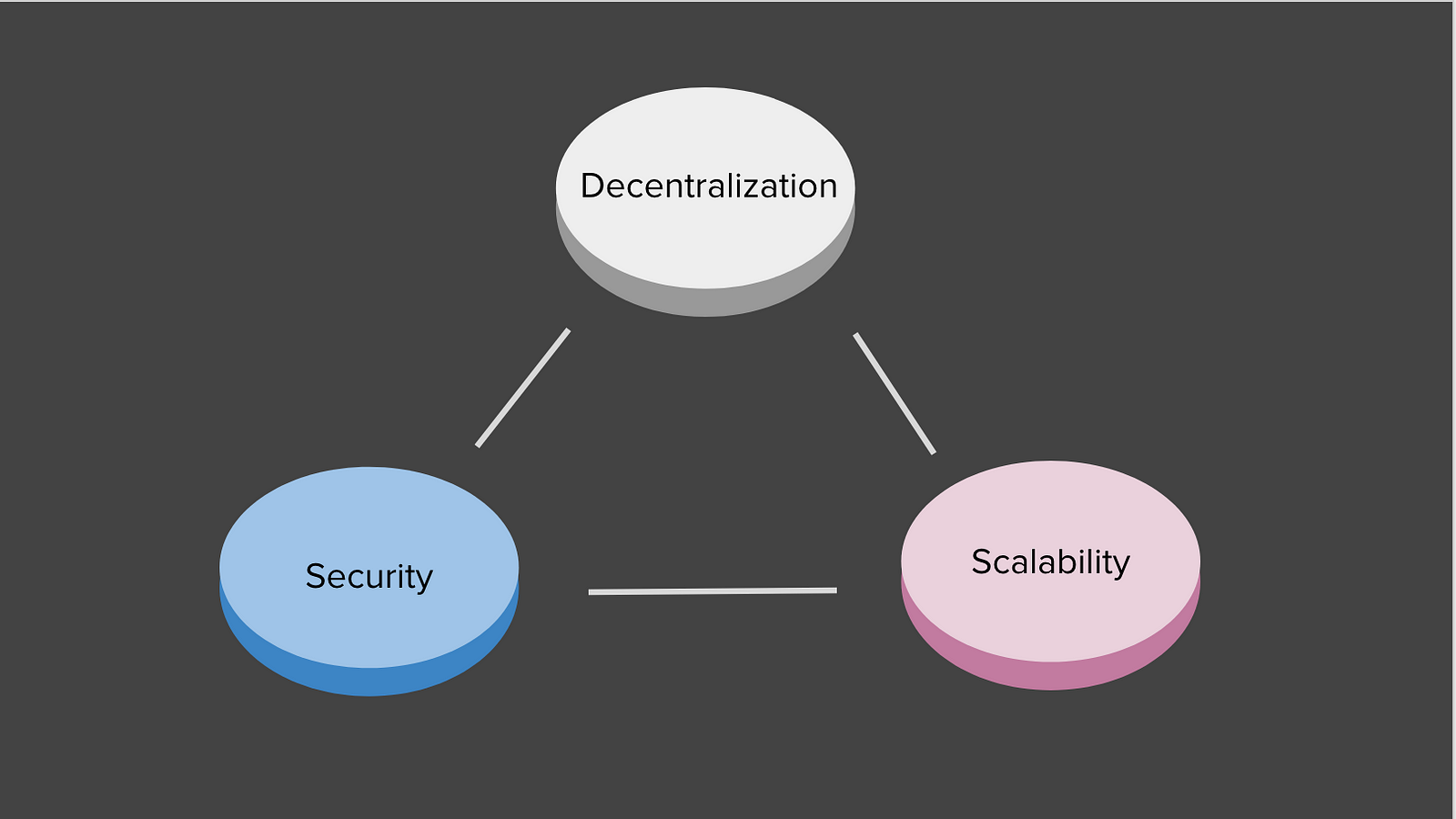

Further, we have the problem that Bitcoin can barely handle a dozen transactions per second, and most other cryptocurrencies don’t do much better (for context, Visa is expected to handle tens of thousands). The main bottleneck is the demand for trustless consensus (observe the Scalability Trilemma) and redundant data storage. Fortunately, blockchain’s Scalability problem is its most heavily researched topic: short-term solutions include setting up permissioned ledgers with faster consensus or Not Using Blockchain; long-term solutions include Proof of Stake implementations, sharding, side chains, and state channels.

Leave a Reply