When one begins to think about the systems underlying identification, credit history and capital flows, it’s hard to not be immediately be blown away by the potential that a permissionless, tamper-resistant ledger has for increasing the transparency of, and ease of access to, vital information. All three obstacles are the result of interdependent central stores of information held by a myriad of parties, each with their own incentives. Governments are the gatekeepers of formal personal ID documents, private companies are generally responsible for maintaining credit history, and global financial institutions determine the cost of moving capital. Trust amongst the various parties is extremely low, as represented by the increasing number of quangos and regulatory bodies we see worldwide.

Applying Wesley Graham’s “A Simple Guide to Blockchain Use Cases”, financial inclusion use cases should be easy to come by, given the involvement of various parties (political and non-political) who need to coordinate across borders and trust the validity of interdependent transactions. So, why does it appear we have seen such little progress in resolving the three obstacles that prevent a level the playing field for the global un(der)banked?

From where I sit, the clear answer is that it’s currently hard to create a blockchain based system that simultaneously satisfies the properties needed for decentralized identification, verifiable credit histories and capital flows. Instead, we see multiple parties attempting to solve each of these problems in relative isolation. Without sufficient thought given to the need to ensure interoperability, we’re at risk of repeating the same mistakes of the past by creating another siloed financial system. Should we really be solving for decentralized identification, credit histories and capital flows independently?

Let me start the discussion with obstacle 1: a lack of formal identification for individuals:

Obstacle #1: A lack of formal identification for individuals

The fact that you can’t open a bank account or touch the conventional financial system if you don’t have formal ID documents in hand (this applies even when you’re using digital money such as M-Pesa, bKash or Venmo) is at the core of Obstacle #1.

Yes, anti-money laundering (AML) and know your client (KYC) regulations help to prevent illicit flows of capital, however, if you’re in a country where government issued ID is difficult to get hold of and maintain, have fled your homeland due to conflict, or simply don’t have access to the physical pieces of paper (and plastic) that represent human “identity” in the eyes of the law, you’re out of luck.

Solutions such as uPort, Civic, CULedger or those developed by the UN backed ID2020 Alliance have all tried to solve aspects of the ID conundrum. Some have focused on digitizing existing paper-based ID documents, and others on giving users more control over what information is shared and with whom.

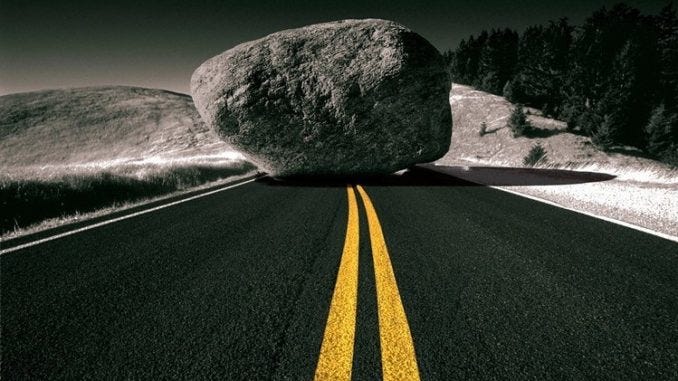

Whilst we have seen some success across the globe, particularly in Estonia (check out this post from my good friend, Justine Humenansky, for a deeper dive into the state of play for digital identity), on the whole, existing solutions have not yet dealt with the one of the most fundamental stumbling blocks (no pun intended) that we need for an effective system — Blockchain’s Decentralized Identity Trilemma. As publicized by Maciek, this trilemma concentrates on the (in)ability of decentralized ID solutions to be:

- Privacy-preserving — meaning that any individual can obtain and use a decentralized ID without needing to reveal personality identifying information such as name or date of birth in the process (i.e. getting hold of a decentralized ID without having to provide your personal information to the ID issuer).

- Self-sovereign — meaning that an individual can create and control as many identities as they choose independent of involvement from a third party (i.e. creating a decentralized ID without the need for a centralized 3rd party)

- Sybil-resistant — meaning that identity is subject to scarcity (the key here being that creating more identifiers cannot be used to manipulate a system)

Many solutions use existing KYC processes to prove the existence of an individual — this creates scarcity but at the cost of privacy and self-sovereignty. Other solutions based on Web-of-Trust principles and Decentralized Identifiers (DIDs) provide for self-sovereignty but are susceptible to sybil attacks. No solutions currently solve for all three.

If Blockchain really is to fix the financial system for those 2.5bn who are excluded, the concept of individual identity may well need to be developed and maintained in a truly Blockchain native way (whatever that means). Additionally, it should focus on the practical and economic constraints often faced by the un(der)banked, rather than looking towards limitations imposed by current banking frameworks.

With a blank piece of paper, what would a true “we can fix it with Blockchain” solution really look like?

Given the practical challenges around validity, acceptability and key management for decentralized ID solutions, I often ask myself whether it truly is possible to live in a world where identity is digital and “central gatekeepers” are not necessary. My heart tells me yes. My head tells me there’s still much work to do.

Assuming we will indeed create a world where the decentralized ID trilemma is solved and formal identification is accessible for all, we still need to think about credit history and capital flows. In the next article I’ll talk about how blockchain technology is dealing with Obstacle #2: the absence of a verifiable credit history for individuals, and Obstacle #3: a lack of access to cheap and accessible flows of capital, as part of its promise to enable a financially inclusive world.

Leave a Reply