The work token has emerged as a novel way of interacting and contributing to decentralized applications.

Before we can dive into current work token implementations, we have to take a step back and analyze early token economic models.

Current Problems:

Fundraising Tools: Many projects simply created tokens as fundraising tools rather than using fiat/ETH. Raising via a traditional equity round or an existing token was more difficult so projects simply released a new token. As a result, even if these projects attain their technological roadmap, they will still see a disconnect between their product and token.

Medium of Exchange (MoE) Models: “Utility” tokens do not automatically result in increased network value with increased token usage. Even after product launch, networks with proprietary payment systems offer little incentive for participants to hold their tokens. Both the supply and demand side can then buy in, use the service, and sell when completed. With inflation, selling pressure will push prices down even further. Vitalik Buterin (Ethereum) and Kyle Samani (Multicoin Capital) have both discussed the issues around token velocity extensively:

“Now, let’s look at the story with a “medium of exchange” token. N people value a product that will exist in a decentralized network at $x; the product will be sold at a price of $w < x. They each buy $w of tokens in the sale. The developer builds the network. Some sellers come in, and offer the product inside the network for $w. The buyers use their tokens to purchase this product, spending $w of tokens and getting $x of value. The sellers spend $v < w of resources and effort producing this product, and they now have $w worth of tokens.

There needs to be an ongoing stream of buyers and sellers for the token to continue having its value.” — Vitalik Buterin

Airdrops: We saw airdrops as a novel way of distributing value; however, they failed to spark real adoption. Sending “interested” addresses tokens was a spray-and-pray model in which the vast number of addresses that even noticed the tokens simply dumped the tokens or provided almost zero value to the protocol.

Speculation: Speculation also caused projects to ignore token economics in 2017 and many now are still avoiding the subject by deferring to “utility” rather than incentives. Aside from failing to deliver on their technology, this will push some projects to their downfall. Even with improved token economics, we will see speculation disrupt market equilibriums.

With these issues, a few projects have begun thinking about their token economics from day one and better align supply side and demand side participants.

Emergence of Work Tokens

Medium of Exchange tokens help exploit the Free Rider problem in which certain market players receive benefits that they have not necessarily paid for. With no skin in the game, token holders who are not active participants will benefit disproportionately from active participants’ efforts. Along with very little incentive to hold the token, constant selling pressure based on external market forces/speculation will push prices down further.

Work tokens introduce a novel way to organize network participants. With proper incentives, participants are, in theory, incentivized to actively contribute to the network.

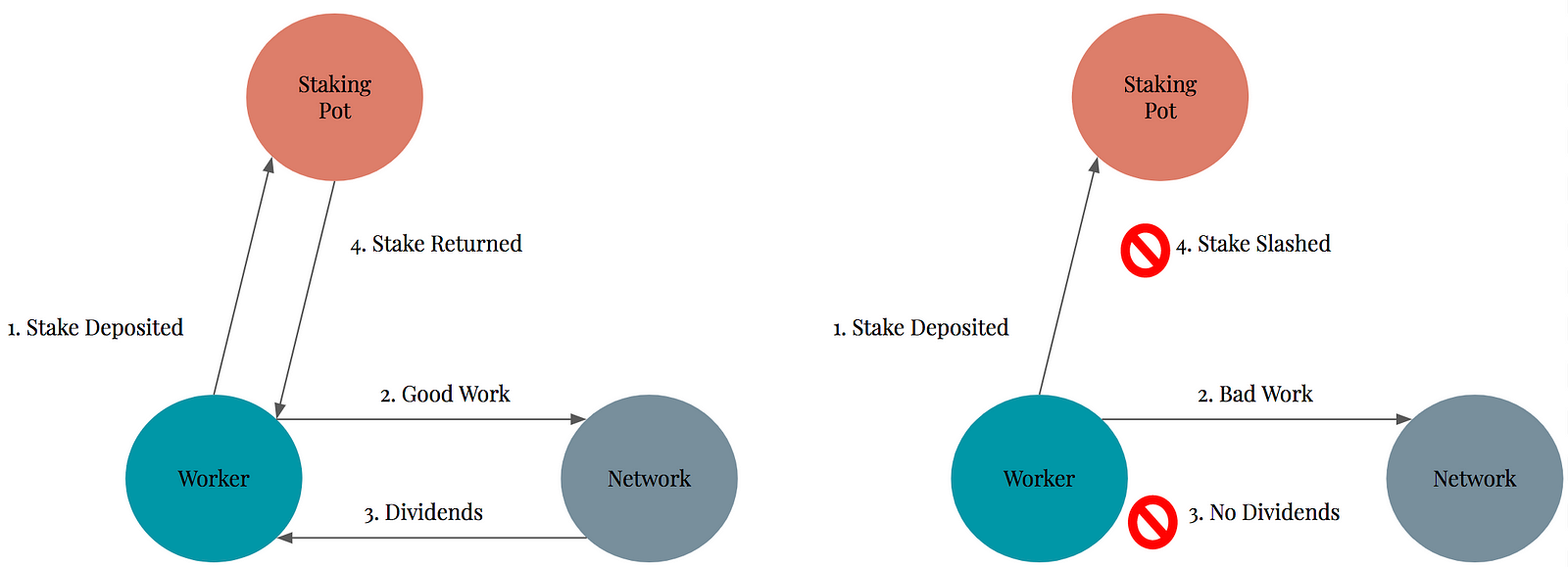

In a work token system, network participants need to stake a certain amount of tokens to provide a service on the network and earn the corresponding fees associated with that work. The common analogy is the taxi medallion model in which individuals pay a high upfront cost to receive a medallion which gives them the right to drive/lease the medallion for additional income.

Work Token Implementations

Augur

Augur is a decentralized prediction market protocol which allows anyone, anywhere to create markets.

Service: The REP Token is required to participate in the reporting and the disputing of outcomes in the prediction markets. Token holders stake behind outcomes they believe are correct with the ability to dispute outcomes as well.

Incentive Structure: Fees are paid out to token holders in proportion to the amount of REP they have staked. Token holders that stake behind inaccurate outcomes will be penalized.

Livepeer

Livepeer provides decentralized transcoding services focused on creating a cheaper solution for live streaming in the Web3 stack.

Service: Nodes stake LPT tokens to perform transcoding work. This process includes converting video inputs into various formats suitable for end user devices and applications. Token holders who do not wish to provide transcoding services themselves can stake behind transcoders. Service providers compete based on fee rate and past performance.

Incentive Structures: Nodes receive fees for providing transcoding services and delegators receive a portion of fees from their respective transcoder. Network participation rate also directly affects the token inflation rate, creating another incentive layer to participate. Transcoders that fail to perform will see their stake slashed and be replaced by other willing nodes.

Additionally, the team introduced the concept of a MerkleMine in which miners compete to compute Merkle proofs to earn a share of LPT. Although this saw a relatively centralized distribution, this was arguably more effective in token distribution than the traditional airdrop model. Only token holders who showed the technical capabilities of computing the proof were seen as token holders capable of providing transcoding services via Livepeer.

The Graph

Graph is building a decentralized query protocol that allows DApps to pull data from blockchains in a more quick and secure manner than centralized indexing services.

Service: Graph tokens are staked to perform a variety of services on the network including indexing relevant blockchain data, filtering data of interest, and validating indexing services. These services are of interest for DApps wishing to query blockchain data.

Incentives: Nodes earn fees for indexing, filtering, and validating with fees going to Graph nodes that provide accurate indexing and querying features.

FOAM

FOAM is creating a decentralized location services platform.

Service: FOAM tokens are staked to add geographic points of interests, curate, signal new locations, and more with the launch of dynamic proof of location.

Incentives: With a TCR, token holders can dispute and verify the accuracy of points added to the network. Also, FOAM token holders that stake their holdings can provide location verification services in exchange for fees.

NuCypher

NuCypher is building a proxy re-encryption network focused on privacy in decentralized systems.

Service: Nodes provide re-encryption services which allows multiple individuals to share private data on public blockchains.

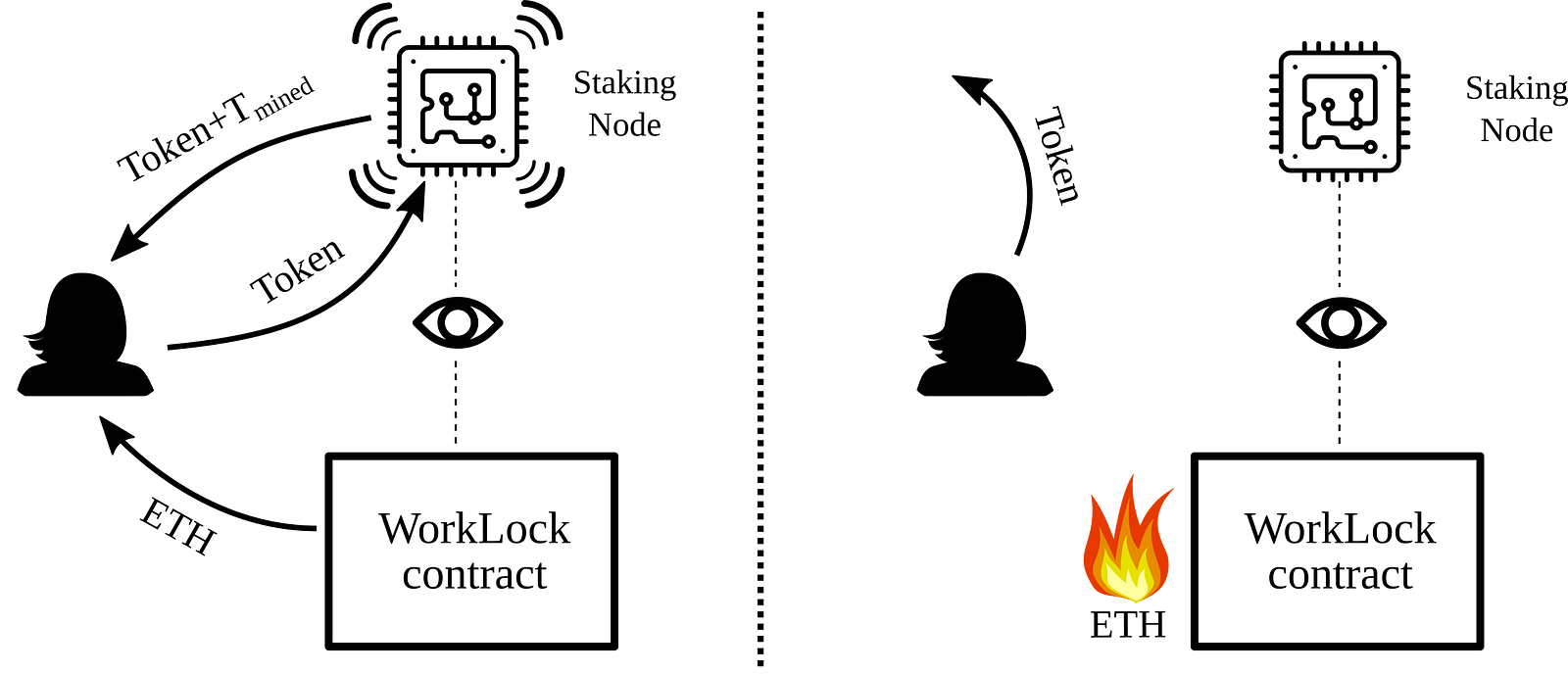

Incentives: Fees are paid out to nodes for their re-encryption services. NuCypher has expanded upon the traditional work token and is looking into the WorkLock Model in which participants lock up ETH and receive tokens to then provide network services. If they use their tokens appropriately, then they will receive their locked up ETH. If not, their ETH will be burned.

This is an interesting take on staking mechanisms, but we will have to see how receptive nodes are to lock up ETH in relation to re-encryption services’ returns. If nodes have to lock up ETH to provide work, they are forgoing other opportunities such as lending through Compound or Dharma.

Valuing Work Tokens

Work tokens are an attempt to better align network incentives on both the supply and demand side. By not treating all token holders the same, active participants can choose to stake, perform work, and earn outsized returns compared to most other token holders. On the supply side, participants able and willing to perform services can begin offering services such as transcoding and querying, providing buyers of the market the opportunity to launch their applications/services with a set of suppliers ready.

As the demand for the service grows, we can project how much in fees nodes performing work on the network will receive.

What are some factors that need to be considered when working on a work token model?

A project simply implementing a work token does not equate to an intrinsic value accrual mechanism.

- Total Addressable Market (TAM) and Serviceable Available Market (SAM)

TAM is a very useful figure for understanding how big of a market a particular project is attempting to tackle. This is usually the total market revenue for a particular good or service. Big markets offer opportunities for disruption and are usually marketed up front; however, relying solely on TAM can be a very misleading value.

In a decentralized context, the project’s SAM should also be analyzed as this points to what value of the centralized market can a decentralized solution capture. This is incredibly important as it is hard to believe that one decentralized network will be able to capture 100% of an industry’s TAM. The SAM, on the other hand, can reveal what section within the TAM is the target market.

For example, Livepeer’s TAM could arguably be the $30 billion live streaming market. However, its SAM could be a smaller section of the market that is looking to transition to a decentralized streaming platform due to censorship, platform restrictions, etc. Not every existing live streamer will see a need to transition to another platform for a potential decreased cost if that means they are giving up larger platform opportunities and network effects found in existing centralized solutions.

2. Fees and Node Participation

With the TAM/SAM analysis, we can transition into how much potential fee generation can occur for a particular product or service. The percentage of total tokens a node stakes determines the amount of work provided to that node and, therefore, the corresponding fees. If the demand for a service grows rapidly, the fees in aggregation will begin to increase. In theory, network participants will see the increased cash flow as an opportunity to earn more and purchase additional tokens to stake.

For example, if DApps using the Graph begin seeing an increased number of transactions, query volume could also increase, providing more fees for indexing and curator nodes.

3. Projected Growth and Net Present Value

By projecting how much the particular service/application will grow, we can project how much fee generation will also grow. This projected growth can reveal how much the total fee pool will grow and the stake value that is required to become a service provider.

With an appropriate discount rate and any assumptions about fee adjustments, we can use NPV to arrive at some indication of what the work token should be worth.

This type of analysis makes many assumptions that vary from project to project, so it’s important to understand where limitations exist.

Work Token Model Considerations:

- Service Provider Concentration/Governance:

As demand for a particular service grows, we could argue that more nodes would want to take advantage of the growing cash flows and enter the market. However, there are barriers to entry that may prevent newer players from entering.

Aside from spending the required amount to stake, nodes may need some type of specialized hardware or technical expertise depending on the service being provided. Unlike general PoW or PoS networks, service layer-work token models may only cater to a small group of network participants from day one such as early investors/hardware specialists who have the ability to actually perform the work required. If a certain node does not perform their work properly, their tokens may be slashed; however, if the barrier to entry becomes higher and higher, then the number of following nodes that can replace the malicious one decreases over time.

This can lead to an increasingly concentrated group of service providers which opens up new attack vectors and possible cartel behavior.

Also, what happens to governance of the network? If network participation has shown to be low already, highly concentrated providers can choose to make protocol changes such as higher fees or staking changes without much discourse.

While work tokens provide more incentive for service providers to be involved in protocol changes, the question comes down to: Which token holders and how concentrated is that decision making power?

The NYC taxi market saw the cost of buying a medallion become higher and higher, providing only a handful of entities the opportunity to enter. These concentrated players then had full control over driver fees and supply, resulting in a poorer service for both customers and drivers. This is not 100% analogous to how work token maturity could play out but an interesting case study to learn from.

2. Fees vs. Cash Flows

With the need for specialized hardware or technical expertise, there needs to be enough incentive for service providers to perform work to compensate for hardware/time. If a decentralized platform is attempting to disrupt a rent-seeker and offer a cheaper service, then the fee charged for the work needs to be low enough to convince buyers to join. However, if that fee is too low, then service providers will not put up the additional hardware/time that is required for this particular service, as their income is too low.

Over time, this could arrive at some market equilibrium, but if the economics don’t incentivize the supply side early then the network will fail to take off.

3. Economies of Scale vs Decentralization

Many work token models are targeting existing centralized services such as video, querying, storage, etc.

Centralized incumbents vastly benefit from economies of scale. That is, the per unit cost decreases over time as total production increases. For example, as AWS has scaled over the past decade, their costs for incremental computing and storage have decreased.

A decentralized service will not benefit from the economies of scale achieved by these centralized players immediately. It will take time to attract active participants willing to perform the work required. This means the network cannot achieve the same cost advantages at the same scale immediately either.

Therefore, a project needs to provide a service in which the factors of decentralization such as censorship resistance, improved long-run economies of scale/reduced fees, removing counter-party risk, etc. need be more valuable than the immediate switching costs and risk.

A work token model that is attempting to disrupt a centralized service without a clear reasoning for decentralization will face a long, uphill battle against years of economies of scale.

This idea ties back into product/market fit. Why does a service need to be decentralized and how does the token model help the network grow?

Conclusion

The work token is helping to solve issues found in many token economies; however, there are definitely limitations that need to be addressed. Two fundamental questions should be addressed in any work token model:

- Does the application truly need its own token?

- How do you incentivize participants to stay active long-term?

As the crypto space matures, we can expect to see multiple iterations of existing work token models.

Leave a Reply